- Brand development strategy and Whys

Launching ‘Green Milk line’ : As the name of the firm suggests, Seoul Milk Cooperative has so far focused mainly on dairy products including milk. I suggest the brand extension strategy, launching non-dairy beverage line named ‘Green Milk’ line including five types of non-dairy beverages, black sesame/almond/cashew-nut/oatmeal/rice milk, which would be the brand development strategy for Seoul Milk Cooperative. Although the new non-dairy beverage line is named as ‘Green Milk’, those are essentially not milk which is a dairy product rather the non-dairy product made of various vegetable ingredients. Newly launching a non-dairy beverage line would be great strategy because of the three reasons.

① Depression of the dairy market

Low birth rate and aging population affect the decline in dairy product demand. The average annual growth rate of dairy businesses is 1.18 percent from 2014 to 2018. [1] The low growth rate of the dairy product market suggests that it is not that easy for the company to expect significant growth without challenging. With the demand for dairy products at a standstill, the transition to non-dairy products would allow the company to grow.

② Rising demand of dairy alternatives

These days, consumers actively seek various drinks as substitutes for the milk and often take nutrients through the other beverages, such as vegetable milk. Dairy Alternatives Market is expected to be valued at more than $3.5B by 2026, suggesting that the dairy alternatives are the global rising trend. [2]

③ Strong brand power of the company

Seoul Milk Cooperative has the largest market share, highest brand competitive index and longest brand history in the dairy business. Company’s strong brand power, which overwhelms other competitors, positively affects consumer responses when launching products in new categories. Consumers apply the trust and expertise given by familiar brands to new products, which also leads to rapid settlement of products and easy entry into the market.

① STP

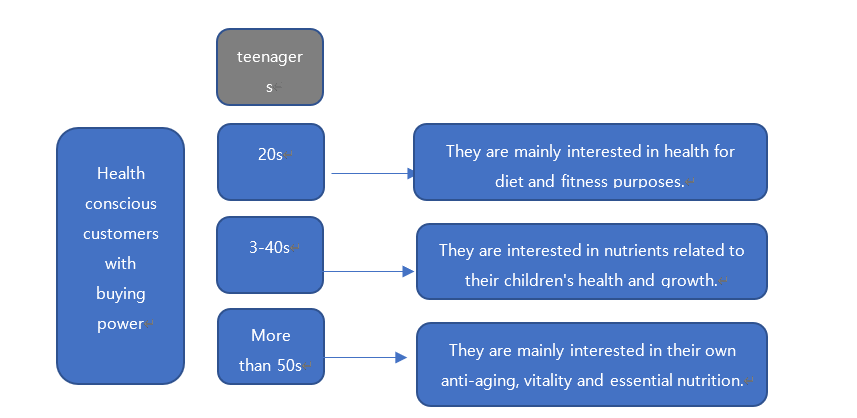

The picture below is the visualization of segmentation and targeting for the Green Milk line. Segmentation used age-based classification. The Green Milk line targets 20s, 3-40s and more than 50s who are interested in and care about their health. Teenagers are not our target, because they have low purchasing power, mainly consume what their parents bought for them, and do not much care about their health.

In the positioning stage, the characteristics of the product should be conveyed in consideration of the customer's needs, so that the customers can remember the product. For the 20s, Green Milk is said to be a new type of milk that allows effective nutrition with fewer calories than milk. In case of 3-40s, marketing should emphasize that Green milk has more diversified nutrients that help children maintain health and grow and it is more effective than dairy milk. For more than 50s, they will focus on the fact that the Green Milk line contains antioxidant components that prevent aging and can increase vitality. Taking different positioning strategies by customers needs, the customer lifetime value would be greater.

② AER

| Acquisition Strategy : emphasizing the need for non-dairy milk |

Expansion Strategy : for the increase of sales |

Retention Strategy : maintain the increased sales |

|

| 20s | Fewer calories | SNS promotion | Continuous launching of the trendy beverage |

| 3-40s | Good for growth of children | 1+1 or bundle pack promotion in the supermarket | Promotion through TV. (for the families often watch TV together) |

| More than 50s | Antiaging | Discounted price | Avoid a sharp rise in prices |

③ SCA : Brand among BOR

The prime SCA of the Seoul Milk Cooperative is strong brand itself. Even if the firm introduces new beverages that has never been seen before, the familiarity of brand image of Seoul Milk Cooperative will allow consumers to quickly resolve the resistance to green milk.

When the attitudinal and behavioral loyalty is both high, the customers have true loyalty toward the brand. Seoul Milk Cooperation has the highest sales and market shares and they have most positive brand image in the dairy industry. The true brand loyalty makes it easier to acquire customers, increases the profit and provides the entry barrier to other rivals.

| High purchase | Low purchase | |

| High feeling | True Loyalty | Latent Loyalty |

| Low feeling |

Spurious Loyalty | No Loyalty |

① Brand Strategy (Brand Positioning, Architecture and Extension strategy)

As a brand positioning, the Seoul Milk Cooperative created healthy and clean image. The firm has brand architecture which is close to a branded house architecture. Firm mostly uses one brand name, ‘Seoul Milk Cooperative’, to the various dairy products, and make use of its positive brand image. The extension strategy of the brand is the brand category extensions, which is launching totally new product category. The promotion cost of the company and the risk and acceptance time of the customers are reduced when the brand successfully launches new product with the strong brand image. In this perspective, if Seoul Milk Cooperative offer a new type of product to the market, the Green Milk line which is the new milk alternative beverage, the risk of the company and consumers would be reduced by the brand image.② Managing brand based SCA

- Three steps to building brand equity

Firstly, firm needs to build a high level of brand awareness. Seoul Milk maintains a good corporate image for consumers. In order to maintain a high level of brand awareness, continuous advertising activities and high product quality, high quality service provision must be made.

Secondly, firm needs to link the brand name to the brand’s points of parity and difference. The points of parity with the other dairy companies of Seoul Milk Cooperative is the fresh image as a dairy product producing company. On the other hand, the points of difference is the traditional image and reliable product quality.

Thirdly, firm has to build a deep emotional connection or relationship between brand and targeted customers. The emotional relationship can be built by continuous and well-constructed integrated marketing communication.

-Integrated Marketing Communication

Integrated Marketing communication means designing and delivering the marketing messages to customers by multiple marketing communication formats. There are many other communication formats in the Integrated Marketing Communication strategy, to apply the integrated marketing communication to the marketing of the Green Milk line, we would conduct two representative marketing methods which are advertising and sales promotion.

Firstly, firm needs to conduct advertising on TV and SNS. The target customers of the green milk line are 20s, 3-40s, and more than 50s. 20s and 30s actively uses SNS and they often recommend certain products to their acquaintances through the comments on SNS. Therefore, the SNS promotion would effectively work for 20s and 30s. And more than 40s, they do not access SNS or the Internet often. They usually get a lot of information from TV and newspapers. Advertisements on TV will be exposed to those who are more than 40s most often, and the advertising effect will be greatest.

Secondly, the Sales promotion would reduce the time of acceptance of the Green Milk line. In the early days of the product's launch, people hesitate to buy the product. Discount promotion can lead to faster market settling for Green Milk. The sales promotion strategy also can be utilized when firm wants to upsell the products. Discounting on heavy buying can improve the sales revenue and then firm can increase the profit.

- Conclusion

The positioning statement of the Green milk is that Seoul Milk Cooperative offer the healthy and new type of milk alternative beverage and satisfy the health-conscious customers, because of the specialty as the top dairy brand. Seoul Milk Cooperative is the strongest player in the dairy industry. However, it is a good strategy to try different product categories because of the slump in the dairy industry and the rising demand of the alternative milk market. Until now, Seoul Milk Cooperative has mainly manufactured dairy products, but if it uses its strong brand power to promote new product categories, Green Milk will also be able to get positive responses from consumers. Green Milk targets customers in their 20s or older who are health-conscious and have purchasing power, and firm utilize different methods by different target groups and AER stages. If the launch of the new product is successful, it will be able to achieve annual sales of 10 billion won.

[1] MarketLine Industry Profile: Dairy in South Korea. (2019). Dairy Industry Profile: South Korea, 1–41.

[2] Wood, L. (2020, January 30). Dairy alternatives market is anticipated to be valued at over USD $35 billion by 2026. ResearchAndMarkets.com. https://www.businesswire.com/news/home/20200130005497/en/Dairy-Alternatives-Market-Anticipated-Valued-USD-35

'경제경영' 카테고리의 다른 글

| 한국은행 통계조사보조원 하는일 / 꿀팁 / 난이도 (1) | 2024.02.07 |

|---|---|

| ['24 1월 연준 FOMC 회의] 정리/성명서 분석 및 3월 금리 예측 (1) | 2024.02.06 |

| LG에너지솔루션 LG엔솔 기업분석/ 이차전지 업계 산업분석 (1) | 2024.02.05 |

| 자동차(모빌리티) 업계 전반 분석 / 현대자동차 기업분석 (1) | 2024.01.29 |

| 투자분석법 - NPV, IRR, PI 비교 (순현재가치, 내부수익률, 수익성지수) (0) | 2024.01.26 |

댓글